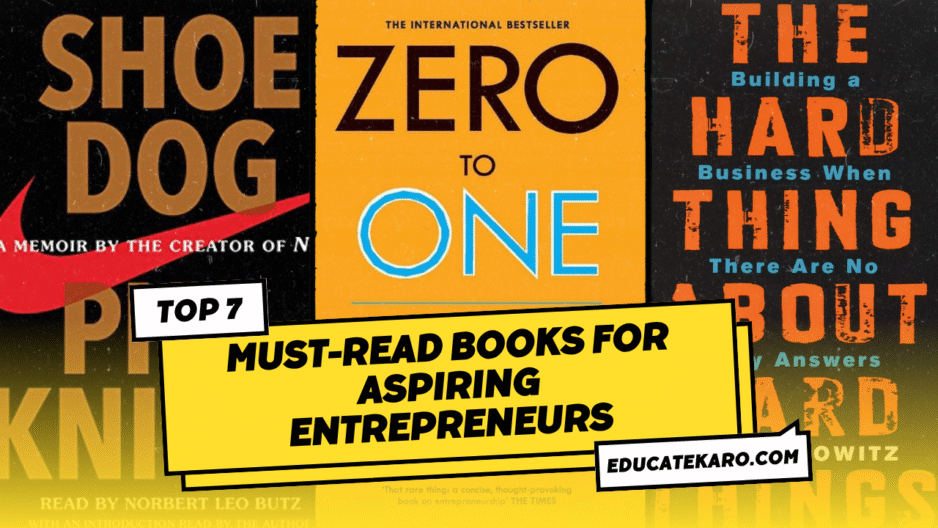

Let’s face it; building something from scratch is chaotic, emotional, and often lonely. Sometimes, a movie just gets that. Whether you’re running a startup, dreaming big, or simply grinding every day, these films will give you more than entertainment; they’ll leave you thinking.

I handpicked these not because they’re award-winners, but because they hit home for anyone on the entrepreneurial journey.

1. The Social Network (2010)

Every future entrepreneur should watch The Social Network. It’s a super honest look at how Facebook started, showing how a big idea, tough decisions, and a lot of determination can build a huge tech company. It really highlights the human side of creating something revolutionary—and it reminds you that new ideas often come with arguments, sacrifices, and surprising problems.

My take: Uncomfortable, intense, and so real. If you’ve ever argued with a co-founder at 2 AM, this will sting (and inspire).

IMDB Rating: 7.8

2. The Founder (2016)

The Founder is a must-watch because it shows both the good and bad sides of being ambitious and persistent, through the story of how McDonald’s became huge. Michael Keaton’s acting as Ray Kroc doesn’t just make you want to work hard; it makes you think about when being driven turns into being a bit ruthless. It asks tough questions about what you’re willing to do to build an empire.

My take: It’s not a feel-good tale, but it’s brutally honest about how success sometimes plays dirty.

IMDB Rating: 7.2

3. Moneyball (2011)

Moneyball is awesome for entrepreneurs because it’s all about breaking the rules and trusting new ideas when everyone else wants to play it safe. Brad Pitt’s character, Billy Beane, pushes for using data to take smart risks. It’s a great reminder for anyone starting something new that thinking differently, believing in the underdog, and being open to change are key to real progress and making a big difference.

My take: Feels like a startup fighting giants with a spreadsheet and a dream. Super relevant for modern founders.

IMDB Rating: 7.6

4. Steve Jobs (2015)

Steve Jobs is electric! Michael Fassbender’s amazing performance makes Apple’s mysterious founder seem like a force of nature—super smart but also sometimes really tough on people. The fast-paced script doesn’t hide his huge ego or his vision. Entrepreneurs will love it because it’s an unfiltered look at obsession, taking risks, and the crazy chaos behind making truly world-changing stuff. It’s a thrilling lesson in ambition.

My take: It captures the price of relentless vision, showing how bold, sometimes brutal leadership makes or breaks innovation.

IMDB Rating: 7.2

5. Joy (2015)

If you need some uplifting movies about starting a business, Joy really stands out. It’s super inspiring about being determined and building something new even when everything is against you. It really highlights the incredible toughness it takes to turn problems into big successes. It’s a must-see if you’re an entrepreneur who needs a shot of motivation when things get tough and people doubt you.

My take: It’s a big-hearted ode to sticking with your dream through failure, skepticism, and chaos, inspiring founders to keep pushing.

IMDB Rating: 6.6

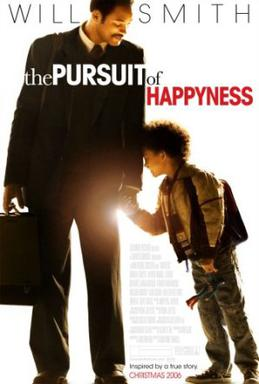

6. The Pursuit of Happyness (2006)

The Pursuit of Happyness is pure inspiration. Will Smith’s portrayal of Chris Gardner’s grit and unwavering hope makes you believe in impossible comebacks. Every heartbreaking setback drives home the hustle it takes to survive and break through. Entrepreneurs will be moved by its faith in perseverance—reminding you that grit can turn rock bottom into a new beginning.

My take: It turns “never give up” into a visceral story, reminding founders that resilience and hope are a startup’s ultimate assets.

IMDB Rating: 8.0

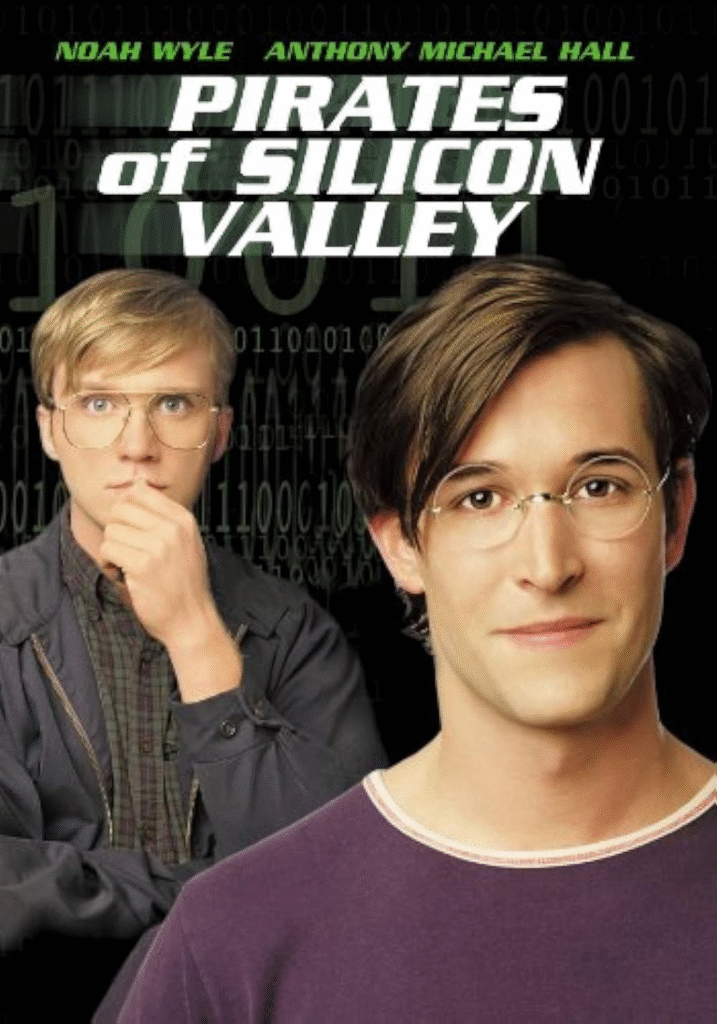

7. Pirates of Silicon Valley (1999)

Pirates of Silicon Valley takes you back to the wild early days of personal computers, showing Steve Jobs and Bill Gates in a crazy, witty race to dominate tech. The relaxed, documentary-like style captures their raw ambition, rivalries, and the bold moves that changed everything. It’s a fast ride through genius, risk, and the sometimes tough truth behind amazing innovations.

My take: It pulls back the curtain, showing chaos, mistakes, and personal clashes behind big ideas. Vision, cunning, and drive build empires.

IMDB Rating: 7.2

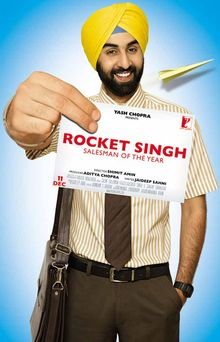

Bonus Pick: Rocket Singh: Salesman of the Year (2009)

Rocket Singh: Salesman of the Year is a breath of fresh air for entrepreneurs. It proves that honesty, clever thinking, and truly caring about your customers can beat shortcuts. It’s a comforting reminder that a business can succeed by being honest and building real connections.

My take: It champions integrity and the power of service—showing that startups can succeed by putting people and trust above short-term gains.

IMDB Rating: 7.5

Final Thoughts

Entrepreneurship isn’t a clean journey. It’s messy, emotional, and full of self-doubt. These movies remind us why we start, why we fall, and why we still keep going. Next time you’re tired of motivational YouTube shorts, try one of these. Who knows; it might just light that fire again.