1. Alphabet Achieves $3 Trillion Market Capitalization

Alphabet, the parent company of Google, broke records by reaching a $3 trillion market value faster than any other technology company. Analysts attribute this success to consistent revenue growth and bold investments in emerging technologies.

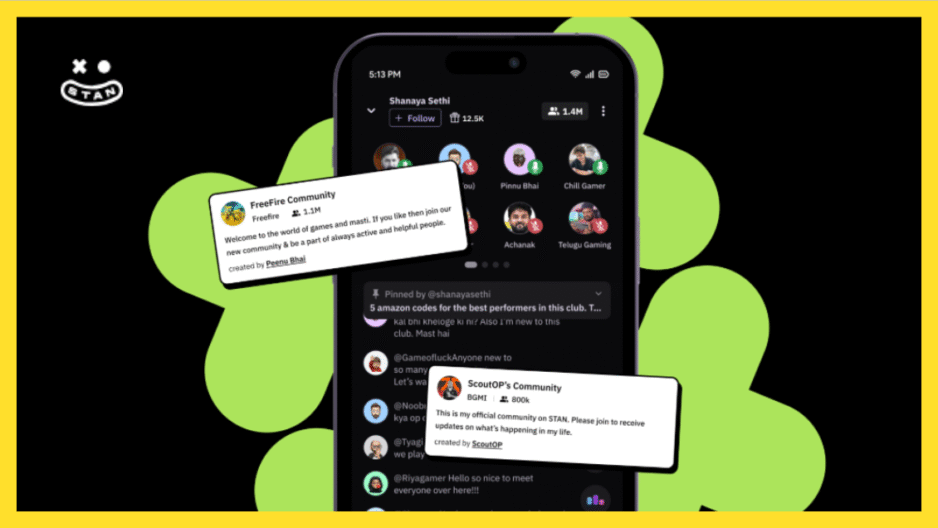

2. Nothing Raises $200 Million for Consumer Electronics Expansion

London-based electronics manufacturer Nothing recently secured $200 million in Series C funding. This investment will support the development of new smartphone features and next-generation consumer devices. Industry observers note that the funding round attracted major venture capital firms.

3. PharmEasy Clears Loan After Major Valuation Cut

Indian healthtech startup PharmEasy has announced the clearance of a significant loan from Goldman Sachs following a recent valuation reduction of nearly 90 percent. This development reflects the continuing changes and challenges in India’s digital health sector.

4. MediaTek to Launch 2nm Smartphone Chip

Semiconductor company MediaTek revealed plans to launch its Dimensity 9500 chipset, built using an advanced 2-nanometer manufacturing process. The announcement signals upcoming innovation in smartphone performance and battery efficiency.

5. Pelocal Raises $5 Million for Fintech Expansion

Fintech platform Pelocal has completed a $5 million Series A funding round, aiming to boost its digital payments infrastructure. The company intends to use the new capital for technology upgrades and market expansion.